Past performance is not a guarantee of future results. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle ®. 'Chase Private Client' is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account. protect or cover purchases if you pay for goods and services using QuickPay. tips to prevent the fraud: Change your security settings to enable multifactor. Your mobile carrier's message and data rates may apply. You can add a Chase travel notice using a computer, the Chase mobile app. Help reversing an 850 Zelle Quick Pay payment through Chase Advice My. For more information, view the Zelle ® Transfer Service Addendum to the Wells Fargo Online Access Agreement. To send or receive money with a small business, both parties must be enrolled with Zelle ® directly through their financial institution’s online or mobile banking experience. Payment requests to persons not already enrolled with Zelle ® must be sent to an email address. The Request feature within Zelle ® is only available through Wells Fargo using a smartphone. Using Chase QuickPay, Chase customers can send and receive money from friends and. Neither Wells Fargo nor Zelle ® offers a protection program for authorized payments made with Zelle ®. Fees may apply for certain other supplies and expedited shipping options. For your protection, Zelle ® should only be used for sending money to friends, family, or others you trust. Choose Send Money from your tab or menu options.

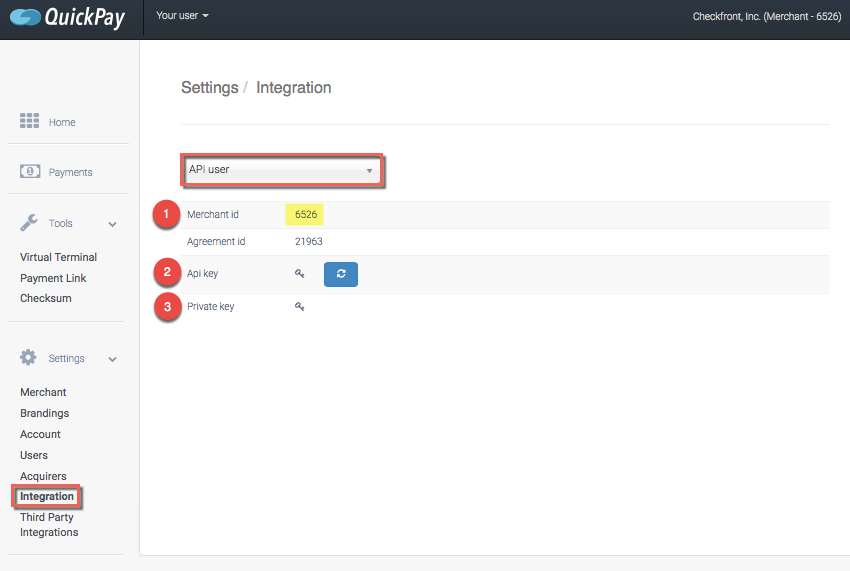

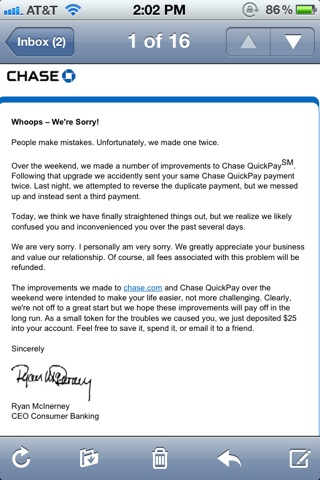

Transactions between enrolled users typically occur in minutes. To use Chase QuickPay to request money: Sign in to your Chase account. Otherwise, you could try calling the police and see if they would be willing to help. If he has a Chase bank account, hopefully you can find someone at Chase that is willing to help you. checking or savings account required to use Zelle ®. You'll probably need to find someone that can help you contact this person to get it straightened out. Locate the button on the side of the card reader. From the SETTINGS screen, tap Card Readers. Three days later, I got an alert from Chase stating that the transaction had. Once you’re signed in to the Chase Mobile Checkout app, tap Settings from the main navigation menu at the top left of your screen. Note: Always call Chase Banking Support to confirm system upgrades and steps to be taken first.Enrollment with Zelle ® through Wells Fargo Online ® or Wells Fargo Business Online ® is required. Once I received the QuickPay email from the buyer on my mobile phone, I accepted the funds and handed over the tickets. Tap 'Set up' next to 'Automatic payments'. You can check to see if your mobile number is already added back and if not, attempt to add it back. Here’s how: After signing in, choose the account for the card you want and tap 'Pay card'. If you try to add your phone number, you may receive a message your mobile number is already setup. Choose your Chase banking account you have QuickPay setup on and confirm if your mobile number is added or not. At the top bar, select QuickPay settings. The email is very alarming since it sounds as if someone gained access to your Chase banking account and intentionally removed your mobile number from Chase QuickPay.Ĭhase banking representatives via phone confirmed that mobile numbers will be restored shortly even if they are not showing up in your QuickPay profile. Select Pay & transfer -> QuickPay with Zelle.

#Chase quickpay settings update

If you have questions or would like us to help you update your Chase QuickPay settings, please call us at 1-87.Ĭhase confirmed a system upgrade overnight generated this automated email about your mobile number allegedly being removed from your account. Please don't reply to this email we're unable to read or respond to messages sent to this address.

If you didn't request this contact change or if you have any questions, please call us immediately or sign in to /QP, open the side menu and choose "Secure messages".

Low and behold there was a quickpay transfer for 500 coming from my checking account to a contact I didnt recognize. Knowing that myself and my wife hadnt, I immediately responded 'No' to the text message and logged on to my chase account. Your XXXXXX was deleted from your profile for Chase QuickPay® with Zelle(SM). On Monday I received a chase fraud alert via text message asking if I recently made a 500 transfer. Look for Zelle in your banking app to get started. If you did not remove your number per the email, this action was confirmed by Chase banking as part of a “system upgrade”. Zelle is a fast, safe and easy way to send and receive money with friends, family and others you trust. Did you receive an email from Chase banking notifying you about your mobile number being removed from Chase QuickPay with Zelle (SM)? The email is similar to below.

0 kommentar(er)

0 kommentar(er)